Verifying one’s identity involves confirming that a person is who they claim to be. It is a fundamental aspect of security protocols, especially in contexts such as financial transactions, accessing sensitive information, or participating in online platforms. Different verification methods exist, each with its strengths and weaknesses. Understanding these methods can help organizations design effective identity security measures that protect against fraudulent activities and unauthorized access.

Table of Contents

An Overview of Verification Methods

An array of verification methods exists, each serving as a gatekeeper to safeguard individuals’ identity and personal information from unauthorized access. Identity verification is the process of confirming that an individual claiming to be a specific person is indeed that person by satisfying system requirements. Verification can be seen as the point where systems engineering and test and evaluation converge. It plays a crucial role in various domains such as financial institutions, healthcare organizations, and online platforms where sensitive data is involved. All networks and systems should have a verification plan for secure access control to protect users’ information.

Verification methods include but are not limited to knowledge-based authentication (KBA), biometric technologies like fingerprint or facial recognition, and two-factor authentication (2FA). These verification procedures help ensure that only authorized individuals gain access to sensitive information and mitigate risks associated with identity theft and fraud. As technology advances, new methods may emerge, providing even stronger safeguards for protecting individuals’ identities in an increasingly digital world.

Importance of Verification in Identity Security

Verification plays a crucial role in identity security for various reasons.

Here are five key importance of verification in identity security:

Preventing Unauthorized Access

Verification ensures that only authorized individuals can access sensitive information, systems, or physical locations. By confirming the identity of users through methods like passwords, biometrics, or multi-factor authentication, organizations can reduce the risk of unauthorized access and data breaches.

Mitigating Identity Theft

Identity theft is a significant concern in the digital age. Verifying an individual’s identity helps in confirming that they are who they claim to be, reducing the risk of impersonation and fraudulent activities. This is especially important in financial services, healthcare, and e-commerce sectors.

Protecting Personal Data

Verifying the identity of users helps protect their data from being accessed or used by malicious actors. Personal information such as financial records, medical records, and sensitive documents can be safeguarded through robust identity verification processes.

Compliance with Regulations

Many industries are subject to stringent regulations and compliance requirements related to identity verification and data protection. By implementing effective verification methods, organizations can ensure they meet these regulatory requirements and avoid legal consequences and fines.

Building Trust and Reputation

Proper identity verification practices can help build trust with customers, clients, and partners. When people know that their information is being handled securely, they are more likely to engage with an organization or use its services, which can enhance the organization’s reputation and customer relationships.

Types of Verification Methods

Crucial for establishing trust and ensuring the integrity of personal information, the implementation of various methods is necessary to confirm an individual’s identity. These verification methods encompass a wide range of procedures, techniques, plans, and activities that aim to validate the authenticity of an individual’s claimed identity.

Here are some of the most common types of verification methods:

Knowledge-Based Authentication

This method involves prompting the person with questions that only they would know the answers to, such as personal details or historical information. Knowledge-based authentication is widely used in various sectors, including financial institutions and online platforms, as it provides an additional layer of security to protect against identity theft and unauthorized access.

One advantage of knowledge-based authentication is its simplicity and ease of implementation. It does not require any specialized hardware or software, making it accessible to a wide range of users. Additionally, it can be tailored to each individual by using personalized questions based on their personal history or preferences. Another benefit is that knowledge-based authentication can serve as a backup method when other means of verification are unavailable or fail. For example, if facial biometrics cannot be captured due to technical issues or if someone does not possess a valid identification document like a driver’s license, security questions can still be used to confirm their identity.

Knowledge-based authentication plays a critical role in identity security by providing an additional layer of verification through personalized questions. Its simplicity and versatility make it a popular choice for various organizations seeking to protect sensitive information and prevent unauthorized access. However, it is important to note that this method may have limitations in terms of potential data breaches or individuals who may have access to personal information about others. Therefore, organizations should continually evaluate and update their knowledge-based authentication systems to ensure optimal security measures are in place.

Two-Factor Authentication

Two-factor authentication is a widely adopted method that adds an extra layer of security to the verification process by requiring users to provide two different types of credentials. This approach aims to mitigate the risks associated with relying solely on knowledge-based authentication, such as passwords or personal information, which can be vulnerable to hacking and social engineering attacks. By incorporating another factor, typically something the user possesses (e.g., a physical token or mobile device) or something they are (e.g., biometric data), two-factor authentication enhances identity security.

One way in which two-factor authentication can be implemented is through an authentication agency that serves as an intermediary between the user and the service provider. This agency verifies the user’s credentials using multiple factors before granting access. For instance, it may require the user to enter their password and then authenticate themselves using a fingerprint scan or facial recognition technology.

The use of artificial intelligence algorithms can further strengthen this process by analyzing patterns and behaviors associated with legitimate users, detecting anomalies, and flagging potential fraudulent activities for human review. The combination of these factors strengthens identity security by significantly reducing the likelihood of unauthorized access even if one factor is compromised.

Credit Bureau-Based Authentication

Credit bureau-based authentication involves comparing the personal information provided by an individual with the data stored in credit bureau databases. This can include details such as name, address, social security number, and date of birth. By cross-referencing this information, organizations can assess the accuracy and consistency of an individual’s identity claims. The extensive data maintained by credit bureaus allows for a comprehensive evaluation of an individual’s background and financial history, making it a valuable resource for verifying identities.

The design of a credit bureau-based authentication system must ensure secure access to these databases while protecting sensitive personal information. Robust encryption protocols and strict access controls are necessary to safeguard against unauthorized access or breaches. Additionally, regular audits and monitoring should be implemented to detect any suspicious activities or potential threats to ensure the integrity and confidentiality of the system.

Database Methods

Database methods are essential for ensuring the accuracy and reliability of identity verification processes. These methods involve the use of databases to store and retrieve information about individuals, such as their details, financial history, and any previous instances of fraud or identity theft. By cross-referencing this information with the data provided by the individual during the verification process, database methods can help determine whether the person is who they claim to be.

One important aspect of database methods is the use of ‘human in the loop’ procedures. This means that human analysts review and validate the results generated by automated systems to ensure their accuracy. Human analysts have a deep understanding of analytical techniques and can detect patterns or anomalies that may not be apparent to automated systems alone. By incorporating human expertise into the verification procedure, organizations can increase confidence in their results and reduce false positives or negatives.

Online Verification

Online verification processes rely on digital technologies and algorithms to assess the authenticity and integrity of an individual’s provided information, ensuring a seamless and efficient identity verification process. These processes involve the use of advanced software systems that can collect, analyze, and compare data from various sources to verify the accuracy of the information provided.

One key aspect of the online verification technique is its ability to conduct visual examinations through digital means. This allows for the comparison of images or documents provided by individuals with reference materials to detect any discrepancies or signs of tampering. Digital algorithms can analyze minute details such as pixel variations or patterns that may not be visible to human eyes, enhancing the accuracy and reliability of the verification process. Furthermore, online verification offers a more streamlined approach compared to traditional methods like manual document checks. The use of automated systems reduces human error and speeds up the overall process while maintaining a high level of security.

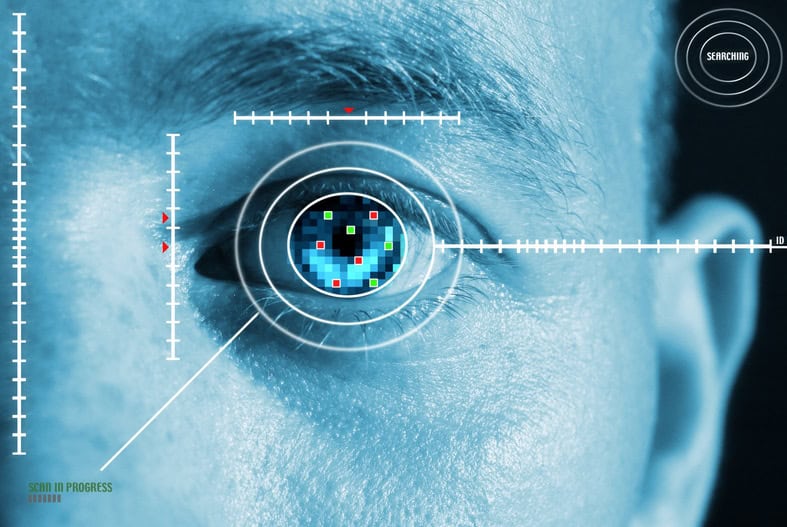

Biometric Verification

Biometric verification methods utilize unique physiological or behavioral characteristics, such as fingerprints, iris patterns, or voice recognition, to establish a person’s identity with a high level of accuracy and reliability. Unlike traditional verification methods like passwords or PINs, biometric verification can verify physical design features that are specific to an individual and cannot be easily replicated or stolen. By analyzing these distinctive attributes, biometric systems can verify user poses by comparing them against pre-registered data stored in a database.

One of the most commonly used forms of biometric verification is fingerprint recognition. Every individual has a unique pattern of ridges and valleys on their fingers, making it highly reliable for establishing identity. Another widely employed method is iris recognition which analyzes the intricate patterns within the colored part of the eye. Voice recognition is also gaining popularity as an effective biometric verification method. It examines vocal characteristics such as pitch, tone, and speech patterns to determine if they match the registered user’s voice sample.

The use of biometric verification significantly enhances identity security by providing a more accurate and difficult-to-forge means of verifying individuals. Since physical characteristics are unique to each person, it becomes extremely challenging for impostors to deceive the system using false identities or stolen credentials alone. Moreover, unlike traditional authentication methods that can be forgotten or shared with others, one’s biological features remain constant throughout their life span. This ensures long-term reliability in maintaining identity security across various applications such as access control systems at airports, financial transactions online or offline, and even unlocking mobile devices securely.

Where Is It Necessary To Verify Identity?

In various sectors such as finance, healthcare, and government agencies, the verification of individuals’ identities is an essential requirement. This ensures that only authorized individuals have access to sensitive information or perform crucial transactions.

The necessity to verify identity arises in several scenarios, including:

Access Control

Many organizations require individuals to verify their identities before granting them access to restricted areas or confidential information. Biometric verification methods such as fingerprint recognition or facial recognition are commonly used for this purpose.

Financial Transactions

Financial institutions need to verify the identity of customers before allowing them to perform transactions such as opening a bank account, applying for a loan, or making large transfers. This helps prevent fraud and protects both the customer and the institution from financial losses.

Healthcare Services

In the healthcare sector, verifying patients’ identities is crucial for accurate diagnosis and treatment. It also helps prevent medical identity theft and ensures that medical records are securely accessed only by authorized personnel.

Government Services

Government agencies often require identity verification for various purposes like issuing passports, driver’s licenses, voting registration, or accessing social welfare programs. Confirming a person’s identity helps maintain integrity in these processes and prevents fraudulent activities. To perform verification effectively, organizations rely on various verification activities like verifying physical design features (such as fingerprints or retinal patterns), performing background checks against databases with relevant data derived from official documents (e.g., passports), validating external interfaces (such as connecting with other governmental agencies for cross-referencing), and utilizing secure systems that protect personal identity information from unauthorized access.

Limitations of Verification Methods

Verification methods, while essential for security and authentication, have their limitations. It’s important to be aware of these limitations to understand their vulnerabilities and potential drawbacks.

Here are some common limitations of verification methods:

Vulnerability to Phishing

Many verification methods, such as passwords and PINs, can be susceptible to phishing attacks. Phishers may trick individuals into revealing their credentials or personal information by impersonating trusted entities through deceptive websites or emails.

Forgotten or Lost Credentials

Passwords, PINs, and physical tokens can be forgotten or misplaced, leading to difficulties in accessing accounts or systems. Password recovery processes, while necessary, can introduce their security risks.

Biometric Data Privacy

Biometric verification methods, like fingerprint or facial recognition, rely on sensitive personal data. If this data is compromised, it cannot be changed, unlike passwords, which can be reset. Storing and protecting biometric data is crucial to prevent privacy breaches.

Reliance on Trustworthiness of Verification Sources

Verifying identity-based on documents, such as driver’s licenses or passports, relies on the trustworthiness of the issuing authorities. If these documents are obtained fraudulently or through corruption, the verification method can be compromised.

False Positives and Negatives

Biometric verification methods, such as facial recognition, may produce false positives (allowing unauthorized individuals to access systems) or false negatives (denying access to legitimate users) in certain conditions, such as poor lighting or changes in appearance.

Social Engineering

Some attackers may exploit human psychology and social engineering tactics to manipulate individuals into revealing their credentials or other personal information, bypassing the verification process.

Overreliance on Single Factors

Single-factor authentication methods, like using only a password, may not provide sufficient security on their own. Multi-factor authentication (MFA) is often recommended to enhance security by combining multiple factors, such as something the user knows, has, or is.

Frequently Asked Questions

How Long Does the Verification Process Usually Take?

The duration of the verification process varies widely depending on the specific context and the methods used. Online account creation, can take just a few minutes, involving email verification or SMS codes. In more complex scenarios like background checks for employment or extensive KYC processes in financial institutions, the verification process can take days or even weeks to complete due to the need to collect and verify various documents and information.

What Are Some Common Challenges or Limitations Associated With Biometric Verification?

Common challenges and limitations associated with biometric verification include false acceptance or rejection rates, vulnerability to spoofing attacks, privacy concerns, and the need for specialized hardware. These factors can impact the reliability and effectiveness of biometric authentication systems.

Are There Any Legal or Regulatory Requirements for Identity Verification?

Legal and regulatory requirements for identity verification exist to ensure the accuracy, privacy, and protection of personal information. Compliance with these requirements is necessary to prevent fraud, identity theft, and other security breaches in various sectors such as finance, healthcare, and government.

Can Verification Methods Be Used Interchangeably Across Different Industries or Sectors?

Verification methods are not always interchangeable across different industries or sectors. The choice of verification method often depends on the specific requirements, risks, and regulatory guidelines of each industry. For instance, the identity verification processes used in the financial sector, like Know Your Customer (KYC) regulations, differ from those in healthcare or travel, where unique considerations and documentation are involved. Thus, while some verification methods may have common elements, their application may need to be tailored to meet the specific needs and compliance requirements of each industry or sector.

Is It Possible for Someone To Bypass or Manipulate the Verification Process?

Bypassing or manipulating the verification process is possible in various ways, including identity theft, using false documents, exploiting system vulnerabilities, or social engineering. These actions undermine the integrity of verification methods and pose significant risks to identity security.

What Is Verification Testing?

Verification testing is a process aimed at assessing and confirming the performance capability of a system or product to ensure it meets the specified requirements and standards. It involves rigorous testing procedures to determine whether the system or product functions as intended and delivers the expected performance. Verification testing is crucial in various industries, from software development to manufacturing, to validate that the performance capability aligns with the defined criteria and that the product or system performs reliably.

Conclusion

The importance of verification in identity security cannot be overstated. It enhances trust between individuals and organizations by safeguarding personal information and preventing unauthorized access. As technology advances and threats become more sophisticated, it is essential for organizations to continually improve their verification processes to stay one step ahead of potential risks. By doing so, they can effectively protect identities and maintain a secure environment for both themselves and their users.